U.S. economic growth decelerated slightly more than anticipated in the final quarter of 2024, according to a report by the Commerce Department on Thursday. Gross domestic product (GDP), which measures all goods and services produced in the U.S. economy, indicated that the economy expanded at a 2.3% annualized inflation-adjusted rate in the fourth quarter. Economists surveyed by Dow Jones had predicted a 2.5% increase following a 3.1% growth in the previous quarter.

The report concluded 2024 on a somewhat subdued note, despite maintaining reasonably solid growth. GDP for the entire year increased by 2.8%, compared to 2.9% in 2023, with growth at 2.5% from the fourth quarter of 2023 to the fourth quarter of 2024. This release is the first of three estimates that the Bureau of Economic Analysis within the Commerce Department will provide.

Mike Reynolds, vice president of investment strategy at Glenmede, noted, “Today’s GDP report confirms that the U.S. economic expansion continued into the end of 2024 on relatively firm footing.” He highlighted the strength of household spending in the fourth quarter, emphasizing its significant impact on the broader economy.

Consumer spending, which accounts for about two-thirds of all economic activity, rose by a robust 4.2%, contributing significantly to the overall growth. Government spending also played a role, increasing by 3.2%. However, trade had a negative impact on growth, with both imports and exports declining.

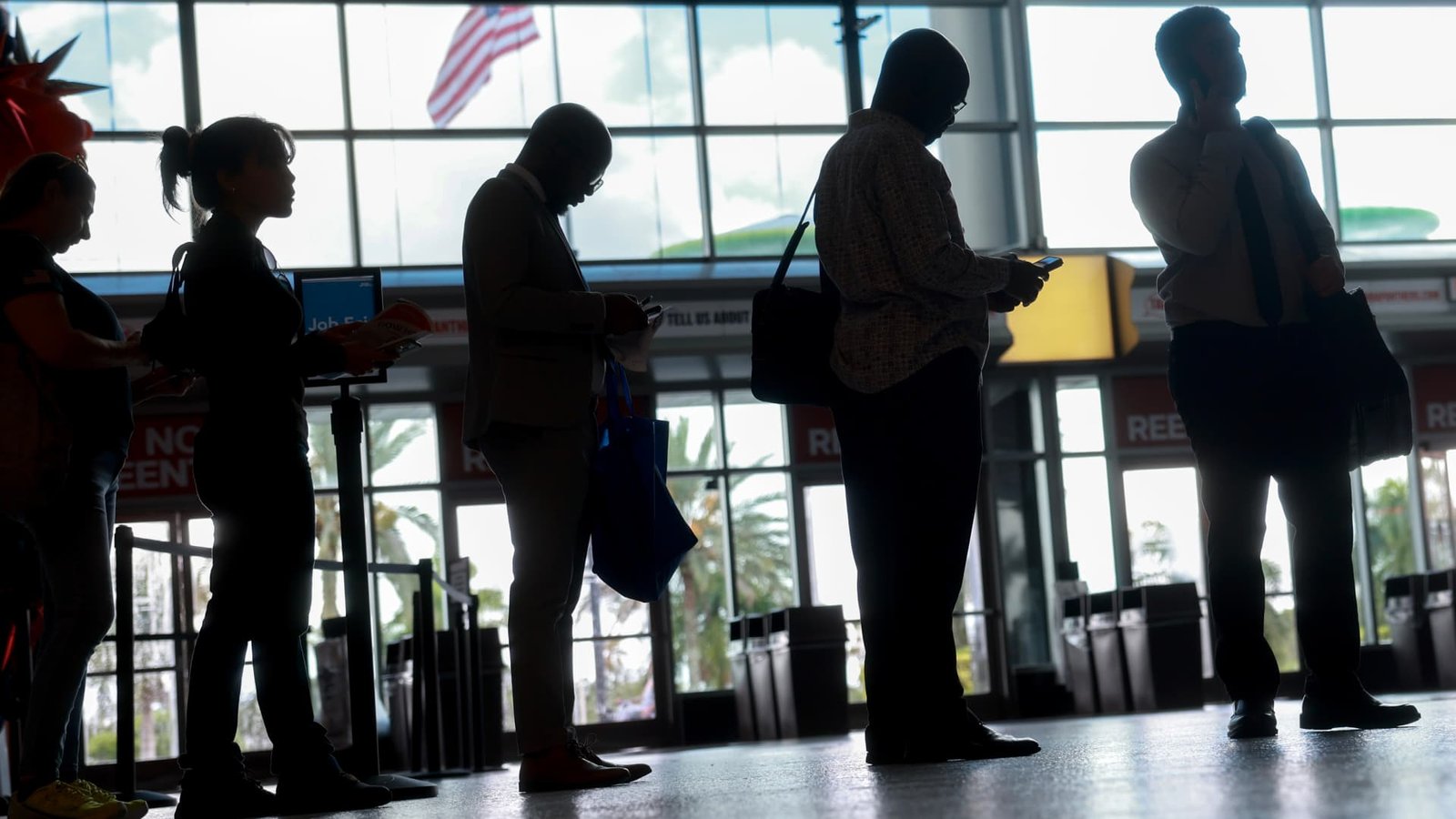

In other economic news, the Labor Department reported that initial unemployment claims for the week ending Jan. 25 totaled 207,000, a notable decrease from the previous period. Continuing claims also fell to 1.86 million.

The Federal Reserve has maintained a patient approach to monetary policy due to the resilience of the U.S. economy and the easing inflation. Despite a recent interest rate cut, Fed officials have indicated that further aggressive reductions are unlikely in the near future. Chair Jerome Powell emphasized that there is no rush to ease monetary policy.

While concerns have been raised about a potential stall in inflation decline, the chain-weighted price index showed a 2.2% increase in prices in the fourth quarter. However, the report also revealed that consumers are tapping into their savings to support their spending, with the personal saving rate dropping to 4.1%, the lowest level in two years.