U.S. President Donald Trump recently announced significant tariffs on the United States’ top three trading partners, causing investors to react swiftly to prepare for a potential global trade conflict. Canada and Mexico are facing 25% duties on their exports to the U.S., while Chinese goods will be subject to a lower 10% levy. In response, Canada has imposed retaliatory tariffs of 25% on $155 billion worth of U.S. goods.

Trump has indicated that the European Union and the United Kingdom could be the next targets of these tariffs. Despite Trump’s prior warnings about tariffs during his campaign, Deutsche Bank analyst Jim Reid noted on Monday that the market had underestimated the risks and would now face significant repercussions.

The immediate impacts of these tariffs are expected to include a slowdown in global economic growth, particularly affecting countries with large manufacturing sectors, an increase in oil prices, higher prices for U.S. consumers, and prolonged higher U.S. interest rates leading to a stronger U.S. dollar. Sectors worldwide are bracing for the effects of these tariffs.

Automobile companies, including car manufacturers and parts suppliers, are anticipated to be heavily impacted by the escalating trade tensions due to their substantial international imports into the U.S. European automakers experienced a sharp decline in stock prices on Monday, reflecting concerns about a sector slowdown.

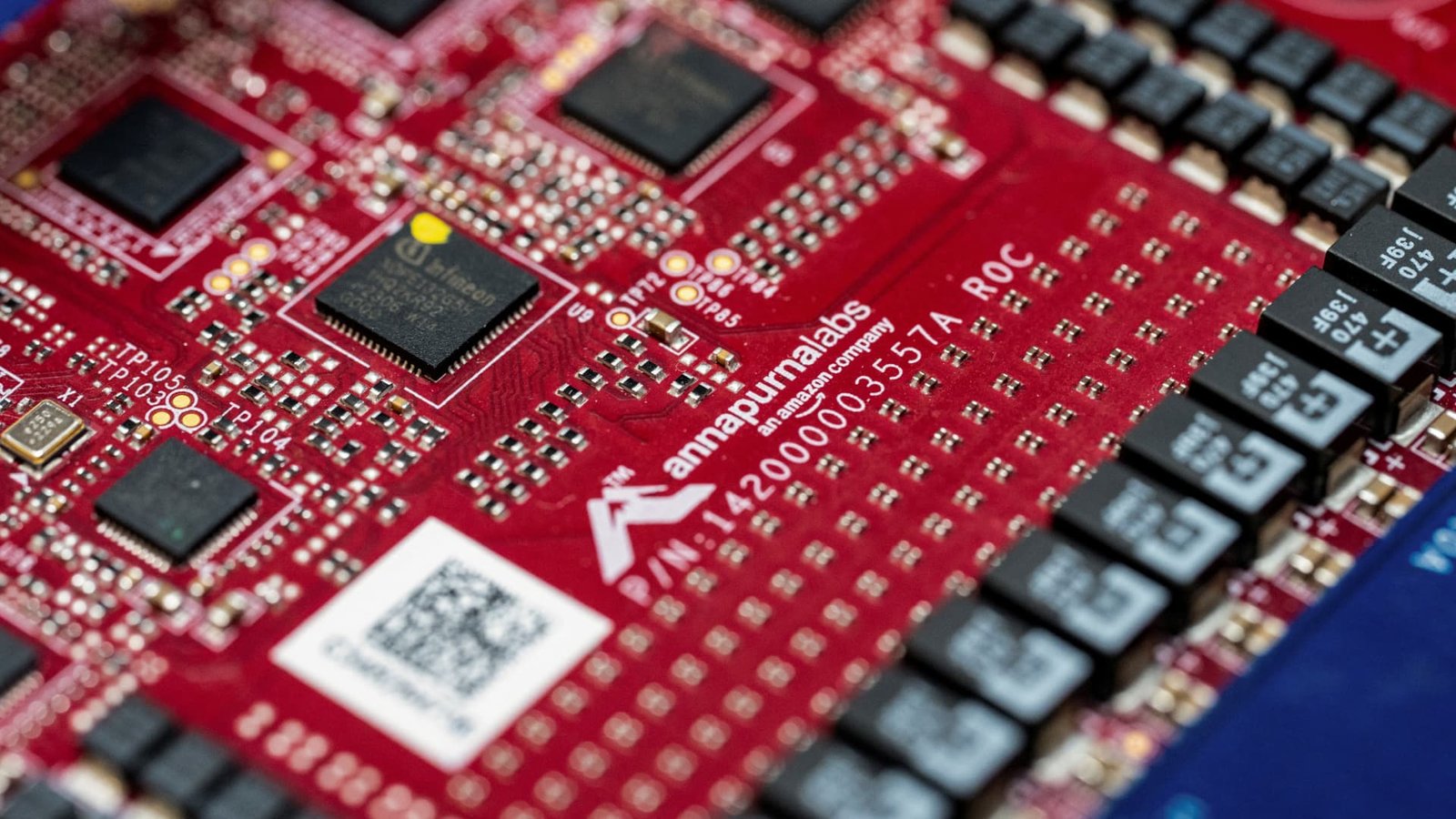

Chip and semiconductor manufacturers, such as Taiwan Semiconductor Manufacturing Co and ASML, are preparing for the impact of tariffs on their global supply chains and potential demand slowdown. The semiconductor sector is facing high tensions due to the recent tariff developments.

Consumer goods made overseas, including household items and leisure products, could see price increases for U.S. consumers. Additionally, U.S.-exported products facing tariffs from retaliating countries like Canada will have an impact on consumer goods firms globally.

Chinese companies, particularly online shopping platforms like Temu, Shein, and AliExpress, are at high risk from the tariffs and changes in U.S. market access. The removal of the “de minimis” trade exemption is expected to significantly affect Chinese e-commerce companies shipping products to the U.S.

Basic materials companies, including those involved in mining and industrial production, are likely to face challenges due to a weaker global growth outlook. Renewable energy producers worldwide may also be impacted by tariffs, affecting the production of machine parts used in green technologies.

The economic repercussions of these tariffs are expected to be particularly severe in Canada, with analysts warning that tit-for-tat tariffs with the U.S. could have detrimental effects on the country’s economy, productivity, and trade diversification. The softwood lumber industry in Canada is highlighted as being particularly vulnerable.

In conclusion, the imposition of tariffs by the U.S. on its trading partners is expected to have far-reaching effects across various sectors globally, with industries such as automobiles, semiconductors, consumer goods, and renewable energy likely to face significant challenges in the wake of these trade actions.